Have you ever dreamt of earning passive income while you sleep?

Or fantasized about going on a vacation without worrying about the next paycheck.

Enter the captivating realm of passive income, a financial fairy tale that’s become a reality for many.

The Earning Passive Income Dream

Imagine a golden goose, but instead of laying eggs, it’s dropping dollar bills into your bank account regularly without needing your attention. That’s passive income in a nutshell!

It’s the income you earn without actively working for it – think royalties from a book you wrote years ago or rent from a property you own.

It’s about making your money work for you, not the other way around.

Why is Earning Passive Income a Game-Changer in Today’s World?

We live in an era where ‘side hustle’ isn’t just a trendy phrase; it’s a survival strategy. With rising living costs, home prices, and uncertain economic climates, relying solely on a 9-to-5 job is like putting all your eggs in one precarious basket. Passive income acts as a financial safety net, diversifying your income streams and providing a cushion against life’s unexpected turns.

The Alluring Benefits of Earning Passive Income:

Here are some of the exciting benefits of passive income streams.

- Financial Independence: The ultimate dream! Passive income can lead you to a point where you’re not chained to a desk but are free to pursue your passions and hobbies.

- Stress-Reliever: Knowing that you have a steady flow of income, irrespective of your day job, can significantly reduce financial stress.

- A Legacy to Leave Behind: Passive income streams can often be passed down, providing financial security to your loved ones.

- Time Mastery: With passive income, you reclaim your time. Spend it with family, travel the world, or enjoy a quiet cup of coffee on a Wednesday afternoon, knowing your bank balance is still ticking up.

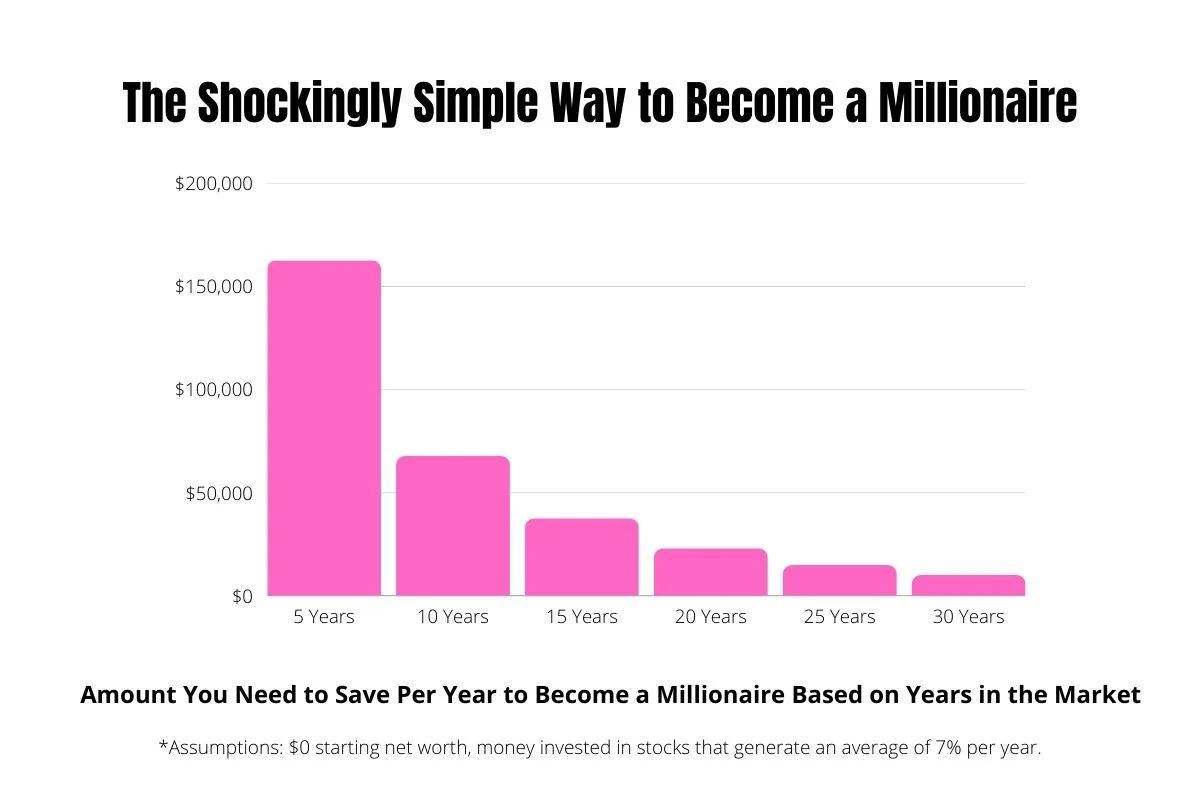

- Beat Inflation: A well-planned passive income strategy can outpace inflation, ensuring your savings don’t lose value over time.

Passive Income Defined

Let’s start by demystifying passive income. One way to think of it is as “money on autopilot.” It’s the income you earn without actively toiling for it day in and day out. This doesn’t mean it’s effortless—it often requires an upfront investment of time, money, or both, but once set up, it can require minimal ongoing effort to maintain.

Examples of Earning Passive Income

- Rental Properties: You own a house or apartment and rent it out. Every month, like clockwork, the rent checks roll in.

- Dividend Stocks: Invest in shares of companies, and voila! You receive dividends periodically.

- Digital Products: A mobile app or online course allows you to do the work once and then sell it repeatedly to new users or students.

- Write a Book or a Hit Song: Every sale or play adds more pennies to your pocket. If enough people consume your content, those pennies can add up!

- Affiliate Marketing and Ads: You can recommend products online and earn a commission when someone buys through your link. You can also create such amazing content that other people are willing to pay you to be featured in an ad on your content.

Earning Passive Income Myths

Now, let’s clear the air with some cold, hard truths.

Myth 1: It’s Easy Money

Reality: There’s no such thing as a free lunch! Setting up a passive income stream requires hard work, research, and an initial investment. It also requires risk. Many entrepreneurs and investors benefit from passive income. However, they have to put their time, money, and reputation on the line with no guarantees of success. It may look easy once done, but the path to passive income isn’t for the faint of heart.

Myth 2: Set It and Forget It

Reality: Even the most passive of income streams need some tending. Markets change, properties need maintenance, and online content needs updates. If there’s enough passive income, you can hire people to maintain your passive income streams for you, but they will cut into your profits, and they could always get bored with the job and quit.

Myth 3: Quick Path to Riches

Reality: Passive income is more of a marathon than a sprint. It can provide a significant financial boost over time but usually doesn’t make you rich overnight. Yes, there are statistical improbabilities of people getting lucky overnight, but those are rare. In most cases, creating passive income streams is possible, but it takes time and, more importantly, patience.

Myth 4: One Stream is Enough

Reality: Diversification is key. Relying on one source of passive income is risky. The only constant in life is change. So, the more streams you have, the steadier your income flow.

Myth 5: It’s Only for the Wealthy

Reality: While having capital helps, there are many ways to start earning passive income with little to no money. Creativity and resourcefulness can be just as valuable as a hefty bank balance. In our modern world, everyone with a computer or smartphone and wifi can access millions of potential customers online. Gone are the days when passive income was just for the rich.

How to Get Started with Earning Passive Income

Embarking on a passive income journey is thrilling, but where do you begin? Here’s what I would recommend:

Step 1: Laying the Financial Foundation for Earning Passive Income

Don’t build something on a weak foundation. Before building a passive income stream, ensure your financial habits are in top shape.

- Evaluate Your Current Financial Health: Start with an honest look at your savings, debts, and monthly expenses. Ensure that you’re not putting your financial stability at risk.

- Pay Down Debt: If you have high-interest debt, pay it down. Many people get desperate and think a new passive income opportunity will save their financial woes overnight. So, they invest in the “opportunity” and go even more into debt. I don’t recommend this. Instead, paying down debt will help you hone your mental skills of patience and perseverance, which will be vital when building your passive income stream.

- Set Aside an Investment Budget: Determine how much you can safely invest without impacting your essential expenses. This could be savings or a specific portion of your monthly income. Do not go into debt for an unproven business or investment opportunity without fully understanding the risk involved.

Learn more:

7 Simple Steps to the Budgeting Process: A Must Read

Step 2: Understand Your Time and Skill Constraints

Time is the one truly limited resource. Be realistic about your time constraints before building your passive income stream.

- Time Availability: Consider how much time you can dedicate to setting up and maintaining your passive income stream. It’s important to balance this with your current obligations. Be realistic about how many hours you can dedicate to building your passive income stream each week. If you have the means, delegate some low-level tasks to make time to build your passive income stream.

- Skill Assessment: Identify your existing skills and how they can be applied. Remember, it’s not enough to be good at something. You need to be good at something that other people are willing to pay you money for.

- Learning and Growth: Be prepared to learn new things. This might mean taking online courses or attending workshops related to your chosen passive income stream. You will also need to be able to allocate time for this.

Step 3: Research and Select a Passive Income Stream

Want to reduce your chances of failure? Do market research and understand the opportunity and your target market before you dive in. Don’t be afraid to get help from people who know more than you.

- Explore Different Options: There are many different types of passive income streams, such as real estate, stock market investments, creating digital products, or setting up a blog or YouTube channel (to only name a few). Each requires different skills, interests, and time commitments. Make sure you explore each option’s pros and cons before selecting one.

- Match with Your Interests and Skills: Choose a passive income stream that matches your interests, skills, resources available, and financial goals. Passion often fuels persistence, so pick something you’ll enjoy. But remember that just because you love something doesn’t mean people are willing to pay you for it. Before diving into a new opportunity, ensure you understand what the market wants.

Learn more:

99+ Ways To Make Extra Money In 2024 (The Ultimate Money-Making Guide)

Step 3: Start Small and Scale Gradually

A growth mindset is an important part of starting anything new. Stay humble and embrace the journey of growth.

- Begin with a Manageable Project: Don’t overextend yourself on your first venture. Start with a smaller, more manageable project to learn the ropes.

- Reinvest and Diversify: As you earn, reinvest your profits and knowledge to grow your passive income stream. Over time, consider diversifying into different passive income streams to spread risk.

Step 4: Regular Monitoring and Adjustment

What gets measured gets managed. Understand your business’s most important data points and watch them closely to take advantage of opportunities or risks when you see them.

- Keep Track of Performance: Regularly monitor the performance of your passive income source. This helps you understand what’s working and what’s not.

- Be Flexible to Make Changes: Be prepared to tweak your strategy in response to market changes, feedback, or performance issues.

Building a successful passive income stream is a marathon, not a sprint. Patience, perseverance, and a willingness to learn and adapt are your companions on this exciting path to financial independence.

Frequently Asked Questions

Here are some of the top asked questions related to earning passive income.

Is Earning Passive Income Really Possible?

Yes! I’m a mom that used to have a 9-5 job. I started small and followed the steps laid out in this blog post. I started creating a passive income business by taking a course and learning how to sell digital products on Etsy. Once I had enough cash, I created passive income by investing in real estate. I’ve also created passive income through dividend investments, my own course, and this blog. It’s been years in the making, but I assure you, it’s 100% possible.

How Can I Balance Earning Passive Income Efforts with a Full-Time Job?

If you have a full-time job, you must develop a clear strategy and create habits and routines that support your goals. For example, this may mean saying no to specific activities or new projects for a while or improving your delegation skills. You also need to clarify which activities are the most important and which are distractions that help you reach your passive income goal quickly.

How Long Does It Take to Earn a Significant Passive Income?

I wish it were easy to give a specific answer, but unfortunately, it depends on many factors. Once I got serious about building a passive income stream, I saw substantial gains within a few months. However, I spent years toiling (and learning) before I reached that point.

Earning Passive Income: The Bottom Line

Despite its promise of earning money with minimal ongoing effort, passive income is not a magic wand or a quick fix to financial challenges. It requires an initial investment, be it time, money, or both, and a continued commitment to nurturing and adjusting your strategies as needed. The beauty of passive income is its potential to provide financial security, freedom, and the ability to pursue passions and interests beyond the constraints of a traditional 9-to-5 job.

Here’s what to remember as you embark on this exciting path:

- Realistic Expectations: Understand that passive income involves upfront work and ongoing maintenance. It’s a long-term game with its set of challenges and rewards.

- Personal Readiness: Assess your financial situation, time availability, and skills before diving in. Choose a passive income stream that aligns with your interests and capabilities.

- Research and Planning: Do your homework. The more informed and prepared you are, the better your chances of success. Set clear, achievable goals and create a step-by-step plan to reach them.

- Start Small and Grow: Begin with manageable projects and gradually scale up. Reinvest your earnings to enhance and diversify your income streams.

- Adaptability: Stay flexible and adaptable to change. The economic landscape is constantly evolving, and so should your strategies.

- Patience and Persistence: Remember, success in passive income doesn’t happen overnight. Stay patient and persistent in your efforts.

Passive income can be a wonderful tool for achieving financial independence and a more fulfilling lifestyle. It offers a way to diversify your income sources, reduces reliance on traditional employment, and provides an opportunity to build wealth over time. By approaching this journey with a well-informed and strategic mindset, you’re setting the stage for a more secure and prosperous financial future.

Still here? Check out this Blueprint for Earning Passive Income

Want to learn my secret to making passive income online? Check out The Shockingly Simple Guide to Selling Passive Income Products on Etsy. This free, in-depth guide is a deeper blueprint for passive income that will help you learn exactly how to create digital products on Etsy!

LEARN MORE:

- Best 19 Income Producing Assets for Passive Income You Need to Know

- How to Start Etsy Business: Insane Tips from a 6-Figure Etsy Seller

- Etsy E-Printables Side Hustle Course: Gold City Ventures Course Review

The friendly agreement

If you found value in this article, please share it. It takes you 10 seconds, and this post took me hours to put together.

Disclosure: This post may contain affiliate links, meaning if you decide to purchase via my links, I may earn a commission at no additional cost to you. See my disclosure for more info.