This is a guest post from Della Kirkman, CPA. If you want to know how to get rich from nothing, she can help. She’s on a mission to help create 10K female acquisition entrepreneurs! In less than 10 years, she went from being a single mom serving tables at Cracker Barrel to buying her first business, growing it, and selling it to achieve the wealth and independence she had only dreamed about.

It was so simple I could kick myself for not doing it sooner.

Just before my 40th birthday, I finally got my act together; I was finally going to be somebody.

I had been waiting tables for years, amongst other part-time gigs, until that day…

I bought a business.

You read that right.

I went from a single mom, 4-star server at Cracker Barrel to buying a business, growing it, and eventually selling it.

While it was simple, and it was, it wasn’t exactly easy.

I had help from friends and family along the way and worked my butt off, but in less than 10 years, my life did a complete 180.

I went from daily money struggles and disconnect notices to building a new home, having a fat bank account, and the “financial freedom” most people only dream about.

How It Started

Before my fate turned around, I was dumping my change jar on the car floor, searching for enough money to buy a couple of days’ worth of gas.

I often paid my bills in the order that things were scheduled to be shut off.

We were getting by, and waiting tables worked great for our situation. I made cash every shift, could pick up extra work when needed, or give away a shift when one of my kids had a field trip or an upset tummy.

I was happy I could be an involved parent. I dropped my kids off and picked them up from school every day. I was a room parent and Girl Scout leader and made dinner every night. That was why I became a mom in the first place.

But, as my youngest daughter transitioned to all-day kindergarten, I felt it was time to shift the focus back to me. I wanted to use my degree, make some real money, and find a way into entrepreneurship that didn’t put our already fragile lifestyle at risk. I had no money to buy a business, my first false notion, and I couldn’t go more than a few days without running the “savings account” dry.

Ready for More

I started with the “help wanted” ads. All the cool jobs I saw required either an MBA, which I didn’t have, or a CPA—more naivete on my part. I thought, “Oh, a CPA. I’m a good test taker. I’ll just take a test and become a CPA.” You’re probably smarter than I was, but I soon discovered that THE CPA Exam is actually four exams. And they’re hard. The next blow came when I found out that even my double major in finance and economics didn’t give me enough credits to be eligible to take the exams in the first place because I was short on total credits and short on accounting credits.

Not Giving Up

It took me two semesters and a summer session to get “caught up.” In the meantime, I found a small tax firm willing to hire me. I had no experience doing taxes except for the few returns I had completed for my brother’s friends in exchange for alcohol.

This firm was willing to hire me to do drop-offs, where you sit in a room in the back and do data entry—no customer interaction. No pressure. Someone else that knew what they were doing would check and correct all my work.

The Unfortunate Disaster

On my very first day, the owner, Ralph, an older gentleman who was also the main preparer, fell on the ice, and shattered his hip into a million pieces. To say it was a disaster is putting it mildly.

I stuck it out, took on way more responsibility, and our small team made it through tax season together and saved the practice. When the owner returned to the office that spring, I told him I was interested in buying his business if he ever wanted to sell. I had no idea how to make it happen, but I put that little nugget out to the universe.

In the meantime, I continued to work at the firm AND the restaurant. I finished my extra courses, then passed all four CPA exams on the first try, within six months of each other! A pretty rare feat, if I do say so myself.

The owner and I talked about me taking over his practice, but I still needed to gain experience. He also entertained an offer from a much larger regional firm, but he didn’t think they would be a good fit for his small-town clients. (A seller motivated by something other than cash.)

A Unique Situation

The business setup was unique. Two separate firms were operating in the same space, sharing overhead items like paper, printers, postage, utilities, and rent. They did not share clients. They operated very independently from each other. I worked for the old guy, Ralph. Ralph had had an established practice for many years. At some point, another accountant, Doug, asked if he could use some of Ralph’s office space to go out on his own. That relationship started long before I came around, but since Ralph was there first, he controlled the space, the phone number, and the fax line (if you remember those).

The Win-Win Business Deal

As Ralph got more serious about selling, Doug became more and more nervous. Ralph’s sale would inevitably have a big impact on Doug’s business; someone else would control the lease, the phone number, etc. Doug thought about buying Ralph’s practice, which I worked for, but he didn’t want a second practice. He wanted control so much that he approached me with the idea of him buying Ralph’s practice and me managing it for him as an employee.

I told him I wanted to be an owner, not an employee. I shared that I had no money for a down payment and didn’t think I could get a loan. However, I did have time. I wanted to work and learn, and I was good with the clients, an accountant with a personality!

Unbelievably, Doug returned and offered me 49% equity in exchange for running the practice and handling the day-to-day tasks! (A partner motivated by more than money.)

We made it official at the end of 2011, right before my 40th birthday.

The Final Numbers

Here is how the deal went down:

- For $0 out of my pocket, I received 49% equity.

- Doug paid Ralph $10,000 upfront for the office equipment and supplies.

- The purchase of the business itself was comprised of monthly payments over five years based on revenue generated from the acquired clients. The business paid for itself. No loan.

- Ralph stayed on as a part-time W-2 employee.

- I ran the entire practice-with lots of guidance from Doug and Ralph, for that matter.

- I received a small salary which covered all my living expenses. Way more than I was making at the Barrel!

- I received a bonus at year-end based on new clients I brought in.

- Every December, we emptied the bank account, except for about $15,000, to cover the next year’s beginning working capital.

- We split that distribution based on our 51/49 ownership percentages.

I was in heaven! I finally had some control of my destiny! And I’m just going to shout this out; I still love taxes!

Learn more:

A New Challenge and a New Opportunity

Out of the blue, early in the tax season 2015, Doug announced that he wasn’t checking our business returns anymore. We were on our own. Progress, right? Then I thought, “If he’s not helping us anymore, I may as well buy him out and run this show alone.” And that’s exactly what I did!

The payoff was made in two payments from the business’s profits. Again, there were no bank loans, no money out of my pocket. The business paid for itself in every way.

I did not put much money in my savings over those first 5 years, but I did end up with a money-making asset, free and clear.

For the next year and a half, Doug and I continued much as we had been, sharing space and utilities. We were growing and expanding, and he wanted to bring his son-in-law into his practice. We searched for a new office big enough to accommodate both of our businesses together, to no avail. Then in the summer of 2016, Doug found an office space for his business, and he moved out of our shared space. It was a bit rough and unexpected, but it was a blessing in disguise.

Creating Wealth

My business continued to grow. We implemented more technologies, increased prices, and focused on community and customer service. As the sole owner with no debt in the business, I was finally able to start creating wealth. And things were good. Heck, they were great! I bought a motorcycle, paid off my truck, and built a new house while growing my bank account, too. But over time, the shine began to wear off. With all the pandemic regulations and tax laws changing daily, it wasn’t fun anymore.

I’m a big believer in fun. Not every task must be filled with giggles and smiles, but one should truly enjoy their daily work. I was no longer enjoying this business, and it was time again to make a change.

Making a Change

In June 2020, I decided to sell my practice, or at least try to sell. I wasn’t sure what to expect. If it didn’t sell, oh well. The money was still coming in. I would find a way to pivot and make it work. If it did sell, I could move on to something else.

But luck struck again because my practice sold within 3-4 months. I received 90% of the funds upfront, with an earnout on the remaining 10%. I was 48 years old at the time of the sale.

What’s Next

Now I have the time and financial freedom to pursue only fun projects. I’m preparing my young adult daughter to buy a duplex for house hacking, and we’re in hot pursuit of a business for her to buy. By age 40, she’ll be leaps and bounds beyond me. And that’s the joy of parenthood, mentorship, and entrepreneurship.

You May Also Like:

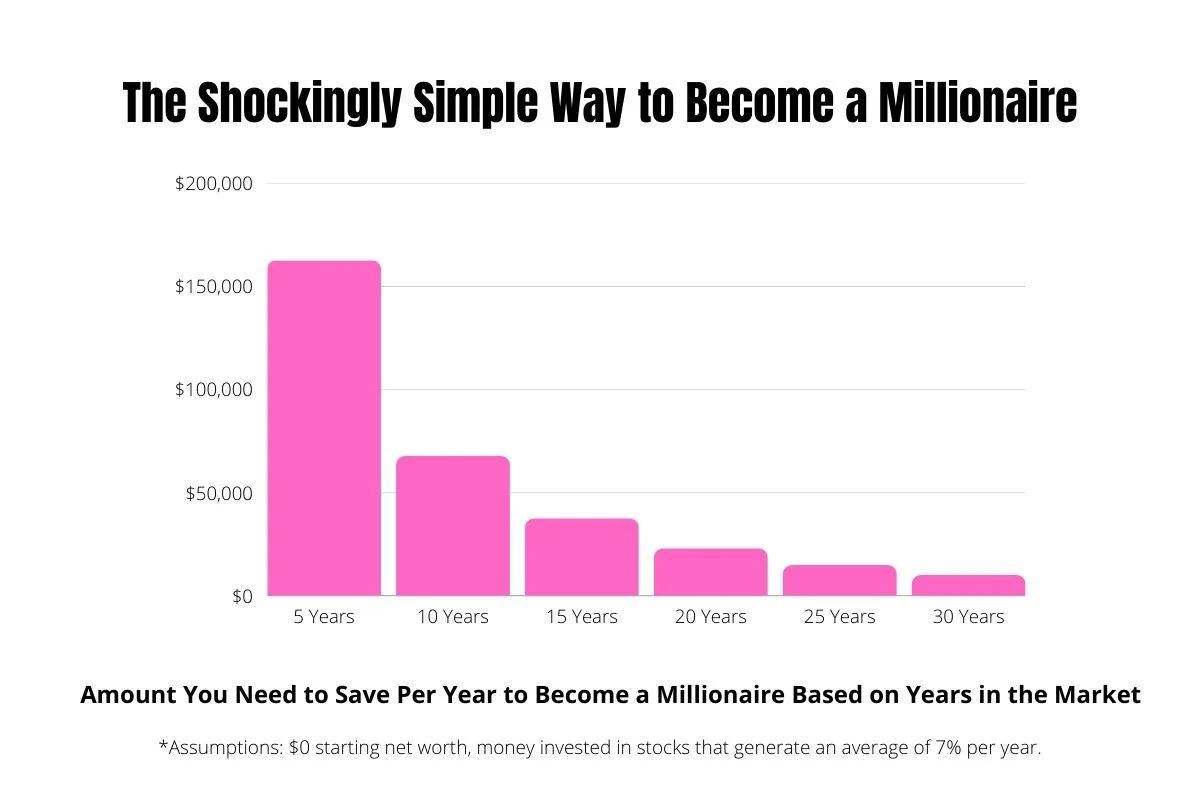

- 3 Simple Wealth Secrets You Need to Know: An In-Depth Guide to Becoming a Self-Made Millionaire

- He Was Facing 12 Years in Prison. Now he’s a Retired Cop and Serial Entrepreneur

- How to Get Rich From Nothing: 6 Surprising Lessons from Andrew Carnegie

- How to Make Money Online: Steal This Simple & Legit Formula to Make $10,000+ a Month

- 7 Simple Ways I Made $4,500 in Passive Income in Only 2 Months and How You Can Too

Advice for Other Women on How to Get Rich From Nothing

I asked Della to share her top tips for women who want to follow in her footsteps. Here’s what she had to say:

got a late start, but it all worked out. It’s never too late to create the life you’ve always wanted. Never.

1. Know yourself

Start with knowing yourself. Know your net worth, your skill set, your cash on hand, your ability to secure financing, and your credit score. Make a list of the things you would like to be doing all day and the things you don’t want to do. List all the quirky things you would like, maybe the ability to take your kids to work with you or to be able to work from home some days while you care for your elderly grandparents. Do a deep dive into the life you want to have as well as your starting point.

Once you have that figured out, look through business-for-sale listings online and note what piques your interest and why.

Online places to find businesses for sale include:

2. Know your industry

Next, get to know the industry you’re interested in. Try to stick with an area you already know, using skills you already have. The banks are more willing to loan when you have relatable experience.

Speaking of loans, your ability to borrow money to buy a business will be based on your credit score (so if it’s low, work on improving it) and the cash flow of the business you are buying and not on how much money you make at your current job.

3. Know how to do the deal itself

This is a complex topic, and you will probably need to bring in professional advisors, but that’s okay. Don’t get hung up here. Just take in little bits of knowledge at a time. Hire good advisors to help you do adequate due diligence and make sure you are purchasing a quality asset.

4. Know how to transition and run the business

Again, this is a huge topic to grasp, but it only takes baby steps. The seller is going to provide at least some training. It’s also a great idea to team up with someone that has already bought a business. That’s a big part of how I had so much success.

For more on Della, check out the Shift-N-Gears.com bi-weekly newsletter, designed to help women buy, grow, and sell small businesses.

Want More Stories Like This?

Get more success stories on how to get rich from nothing and awesome resources related to passive income, personal finance, and positive psychology delivered straight from my brain to yours. Check it out and sign up here.

The Friendly Agreement

If you found value in this post about how to get rich from nothing, please share it. It takes 10 seconds, and this post took me hours to write.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. As always, consult with a qualified financial professional before making any investment or financial decisions.

This post may contain affiliate links that allow this blog to earn money without a cost to you. Many thanks if you use them. Please read my disclosure for more info.