Most people dream of becoming a millionaire “one day,” but few actually make it happen. So a few years ago, I decided to figure out exactly what it would take to become a millionaire. Here’s the shockingly simple way to become a millionaire that everyone should know.

What is a millionaire?

To be clear, being a millionaire doesn’t mean you drive a fancy car or have a $7-million home. As much as the media portrays millionaires and rich people with the finer things in life, technically, you need to have $1 million in net worth to be considered a millionaire. You may or may not have other things people consider “nice” or “fancy.”

What is net worth?

Personal net worth is the total wealth of an individual or household, considering all financial assets and liabilities.

If you didn’t go to business school or have the pleasure (yes, I say that with 100% sarcasm) of taking accounting classes, you may not understand terms like assets and liabilities (I sure as hell didn’t), so here’s a quick overview.

Asset: An asset is a resource of value that an individual owns or controls with the expectation that it will provide a future benefit. Common assets for the average person include their home, car, retirement accounts, stocks, bonds, and cash.

Liability: A liability is basically a fancy word for debt. If you buy something and plan to pay it back later, you are taking on a liability.

Most people have a mixture of assets and liabilities. And one item can be both an asset and a liability.

I’ll explain…

If you buy a $500,000 home and put $50,000 down, then you have an asset in the form of a $500,000 house. You also have a liability of $450,000 ($500,000-$50,000) because that’s how much you owe to the lender. As you make payments on your home, your liability will go down. Eventually, once you pay your home off, you will no longer have that liability, and it will only be an asset to you.

As a general rule, assets add to your net worth, and liabilities take away from your net worth because you usually have to pay interest on debt.

How to Become a Millionaire

Ok, now that we’ve cleared up some definitions and you understand what assets are, let’s talk about why you’re really here– to learn how to become a millionaire.

Buy Assets

One of the easiest and simplest ways to become a millionaire is to simply buy assets. History has proved that the best assets for producing millionaires are businesses and real estate.

How to Buy Businesses

There’s this magical marketplace where people sell pieces of businesses. You can be a partial owner of a business, and in turn, you get to share in the business’s profits and growth. What is the name of this magical marketplace? It’s called the stock market.

You buy little pieces of stocks, and over time they provide additional value in the form of growth and dividends.

How to Buy Real Estate

There are many ways to buy real estate. Of course, you can purchase a home or a rental property, but you can also buy pieces of a lot of real estate in what is known as a Real Estate Investment Trust or REIT. You can buy this on the stock market as well.

Like a stock, you can buy little pieces of a REIT, and over time they provide additional value in the form of growth and dividends.

Other Assets

Businesses and real estate have proven to work well for many people and are easy to buy and sell. However, there are other assets that you can purchase if you know what you’re doing. For example, if you are an art connoisseur, you can buy and sell art. I also knew a guy that bought and sold chainsaws (he would buy broken ones, fix them up, and sell them at a premium). I’m not trying to tell you to put your life’s savings into art or chainsaws; I’m simply making the point that businesses and real estate aren’t the only assets in the world.

Create Assets

Another option is to create assets yourself. For example, you can create your own business that generates value. Then, you can extract value from your business by taking the profits or selling the business to someone else for a premium price.

Earn Income and Spend Less Than You Make

Although not stated before, it’s important to address that to buy assets, you need to have the money to buy them with. So, it’s important to mention that you need to earn income in the first place before you can leverage this strategy. Furthermore, you need to spend less than you make so you have enough left to buy assets. If you need help spending less than you make, I’d suggest starting with a budget.

Simple Math Doesn’t Work

A common mistake is using simple math when thinking about becoming a millionaire. Many people think about $1,000,000 divided by 50 years = $20,000 a year. Then they think, “I have to save $20,000 a year to have $1,000,000 in 50 years!”

But the great news is that that’s not how wealth building works. Instead, if you buy or create assets, as discussed above, you can benefit from the power of compounding interest.

What is compounding interest?

Compounding interest is the interest you earn on interest. Here’s an example to make it more clear:

Option 1- No Interest

You have $100 and put it in a box in your closet. In 10 years, you will still only have $100.

Option 2- Little Interest

You have $100 and put it in a savings account, earning .5% interest per year. In 10 years, you will have $105.11.

Option 3- High Interest

You have $100 and put it in the stock market, earning an average of 7% per year. In 10 years, you will have $196.72.

Which would you rather have? $100 or almost $200? Not too hard of a decision, right?

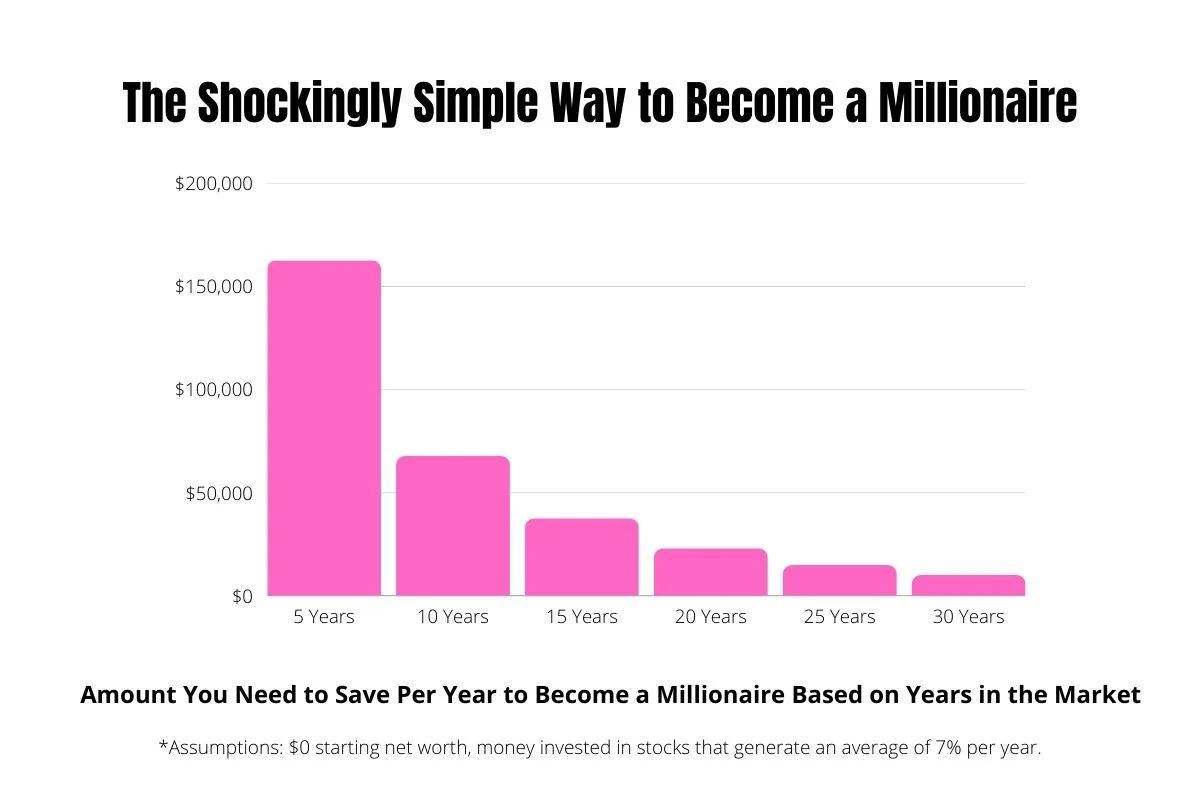

The Shockingly Simple Way to Becoming a Millionaire

Ok, so calculating compound interest takes a more complicated formula. But the great news is that online calculators can make it easy and simple to predict when you’ll become a millionaire based on one important thing you can 100% control– your savings and investing habits.

As you can see in the example below, if this person saves $10,000 a year for 30 years at a 7% interest rate, they should end up with over $1,000,000 in net worth (assuming they started with $0 net worth).

The stock market does have risks and is not guaranteed. However, based on historical data of the S&P 500 since its inception, there’s a high likelihood of something close to this happening.

Predicting When You’ll Become a Millionaire

Want to use this calculator to help predict when you’ll be a millionaire?

Go to this future value calculator, and then simply fill in your information as follows:

- Number of Periods (N) = the number of years you’re trying to predict

- Starting Amount (PV) = Present value of your net worth right now

- Interest Rate (I/Y) = Interest rate %

- If you’re investing in a total stock market index fund, you can use 7%, which is historically the average yearly return of the S&P 500 adjusted for inflation.

- Periodic Deposit (PMT) = how much you invest into buying assets like stocks each year

Taking Action

I hope you played around with the calculator above. How often do you have access to a tool that can predict a piece of your future?! It’s the closest thing I’ve found to a crystal ball.

One thing that may happen when you play with this calculator is that you don’t like what it predicts. Believe me, that happened to me when I first played with it. However, the great news is that you are figuring this information out today, not 10 years from now.

I believe there is no better time than the present moment because that is what we have full control over. So, take what this “crystal ball” is showing you and do something about it. For example, you can work to spend less money with a budget so you can increase how much you invest. Alternatively, you can try to earn more money with a different job or side hustle. Ideally, you can do a combination of both of those strategies.

In doing so, you can control if and when you become a millionaire. Pretty powerful stuff, right!?

Frequently Asked Questions

Here are the most frequently asked questions about becoming a millionaire.

How to become a millionaire in 5 years?

Simply talking from a numbers perspective, if you were to start with a $0 net worth, it would take investing $163,000 per year at a 7% interest to become a millionaire in 5 years. Because the time frame is short, compounding interest is not as powerful compared to if you had a longer time period. Alternatively, another way to become a millionaire in 5 years is to create a grow a business that you sell for $1,000,000 in 5 years.

How to become a millionaire by 30?

If you save and invest $91,100 per year starting at 22 years old with $0 in net worth, you can be a millionaire by the time you are 30. This may sound crazy, but let’s make it a little more realistic. To start at 22 with $0 of net worth as opposed to a negative net worth, you’ll need to find a way to avoid debt for school. If you can do that, you’ll be starting on the right track.

Next, $91,100 may sound like an insane amount, but what if you divide that by 2? For example, if you have a partner and both can make around $90,000 per year, you can each save half of your gross income and have a combined net worth of nearly $1,000,000 by the time you’re both 30. To do this, it helps if you pick a career with a high salary and continue to live like a college student even though you’re making the big bucks.

What can I do to become a millionaire?

The best way to become a millionaire is to spend less than you make and invest the difference consistently over a period of time. The more you invest, and the longer you do it, the more you’ll ultimately have.

How to become a millionaire at a young age?

The best way to become a millionaire at a young age is to avoid lifestyle creep and keep your expenses low while simultaneously increasing your income and investing as much as possible.

What are ways to become a millionaire?

You can become a millionaire by buying assets like businesses or real estate. Another option is to create and sell a business. You can also have a high-paying joy, win the lottery, get an inheritance, win a lawsuit, or have an insurance policy pay you out. Some of these things are more in your control than others. I’d recommend taking action on items that are in your control and have higher chances of success.

Additional Resources on How to Become a Millionaire

Want more information to help you prosper in all areas of your life? Check out my free weekly newsletter with juicy success hacks and awesome resources related to positive psychology, productivity, and personal finance delivered straight from my brain to yours.

Learn more:

How a mom of two became a millionaire with one simple personal finance rule

Want more?

For more specific advice, check out my Ultimate Passive Income Startup Checklist. It’s the consolidated wisdom of my passive income journey and will benefit anyone starting their own passive income venture.

The Friendly Agreement

If you found value in this article on how to be a millionaire, please share it. It takes 10 seconds, and this post took me hours to assemble.