Who hasn’t dreamt of becoming a self-made millionaire?

The thought of becoming a millionaire is enticing and electrifying. Sometimes we even spend money on things like lotto tickets so we can feel that much closer to the idea of being a millionaire one day.

In reality, most people are in one of two camps. The first camp believes they can’t become a millionaire, or it’s too hard due to a maze of financial decisions and strategies, or a level of privilege they don’t believe they have. The second camp believes or knows it’s possible and quite simple.

I’ve created this comprehensive guide to untangle the knots and illuminate the path to becoming a self-made millionaire.

Intrigued? Let’s dive in.

The Basics

The journey to becoming a self-made millionaire may seem steeped in complexity. We often envision it as a labyrinth of investment strategies, tax planning, and risk management. However, at its core, becoming a self-made millionaire boils down to understanding two key concepts: compound interest and the time value of money.

Albert Einstein allegedly referred to compound interest as the “eighth wonder of the world” – a testament to its profound impact on wealth accumulation. So let’s go a little deeper and examine what exactly compound interest is.

Compound interest

In simple terms, compound interest is the interest you earn on your original money and the interest you continually accumulate. It allows your wealth to snowball over time as you earn interest on your interest, not just the original amount of money you put aside.

For example, suppose you invest $1,000 at an annual interest rate of 5%. After the first year, you would earn $50 in interest, bringing your total to $1,050. In the second year, you would not just earn interest on the initial $1,000 but on the entire $1,050. Your interest for the second year would be $52.50, totaling $1,102.50. This process continues for each year you hold the investment, with each year’s interest calculated on the previous year’s total.

The concept of compound interest highlights the importance of time when investing. The more time you give your investments to grow, the more potential your investments have to take benefit from compound interest, which can significantly increase your wealth in the long run. This is why it’s often said that when it comes to investing, the earlier you start, the better.

You must consistently save a portion of your income to leverage compound interest. The specific amount varies depending on personal circumstances, but a common recommendation is at least 20%. These savings are then invested to yield returns, further reinvesting to create a cycle of escalating wealth.

If you’ve ever heard the phrase “the rich keep getting richer,” compound interest is why. Once you have significant wealth, your wealth continues to grow with little to no effort from you.

Time value of money

Next, the concept behind the time value of money is relatively straightforward. It boils down to the fact that if you have money now, you can invest it and earn interest, making the total amount of money you have in the future more than if you just held onto that amount without investing it.

For instance, consider that you have $1,000 today. If you invest this amount in an account with a 5% annual interest rate, at the end of the year, you’ll have $1,050 ($1,000 plus the $50 you earned as interest). Hence, the $1,000 you have today is worth $1,050 a year from now because of the potential interest you can earn.

This principle extends to more complex calculations involving future value (how much a sum of money today will grow to in the future) and present value (what a future sum of money is worth today, given a certain interest rate). This understanding is critical in evaluating investments, making financial decisions, and understanding how interest rates and risk affect the value of money.

Thus, the time value of money emphasizes that the sooner you invest your money, the more time it has to grow, leveraging the power of compound interest, as previously explained. Combining these two concepts – compound interest and the time value of money – forms a foundational pillar of personal finance and becoming a self-made millionaire.

Putting these concepts to work

Now that you have a basic understanding of these concepts, here’s what you can do to put them to work in your life.

1. Invest over time

First, if you understand the power of compound interest, you know that it becomes particularly potent over long periods. The longer your money is invested, the more time it has to compound, resulting in exponential growth. Knowing this, you can invest as early as possible and maintain a long-term perspective.

For example, consider two individuals, Amy and Brad. Both plan to invest $5,000 annually at an average annual return of 7%, but they start at different ages.

Amy understands the power of compound interest and the time value of money. She starts investing at the age of 25. Brad, on the other hand, doesn’t grasp these concepts early and starts investing at the age of 35. They both plan to retire at 65.

Amy would invest for 40 years, while Brad would invest for 30 years. Despite the ten-year difference, the impact of compound interest and the time value of money is profound.

By the time Amy reaches 65, she will have contributed $200,000 ($5,000 per year for 40 years), but her investment will have grown to about $1,068,047 due to compound interest.

On the other hand, when Brad reaches 65, he will have contributed $150,000 ($5,000 per year for 30 years). Despite only contributing $50,000 less than Amy, his investment would have grown to $505,365 at retirement.

Even though Amy only invested $50,000 more than Brad, she ended up with over $562,678 more at retirement. This staggering difference is due to the power of compound interest and the time value of money. Starting ten years earlier gave Amy’s investments more time to grow and compound, resulting in significantly more wealth at retirement.

This example perfectly illustrates why understanding the concepts of compound interest and the time value of money is so important in personal finance. By starting earlier, Amy harnessed these principles to significantly enhance her financial outcome.

2. Manage your debt

Next, if you understand the compound interest and time value of money, you’ll be able to see the true cost of debt. For example, when you take out a loan with compound interest, you’ll pay interest on the interest over time, which can quickly escalate the total debt.

Consider Sarah, who takes out a $20,000 loan to buy a car. The loan has a term of 5 years (or 60 months) and an annual interest rate of 5%, compounded monthly.

If this interest weren’t compounded, Sarah would simply pay 5% interest on the principal of $20,000, amounting to $1,000.

However, with compound interest, Sarah ends up paying more. Here’s how it works: the initial interest for the first month is calculated on the principal loan amount, which is $20,000. Then, in the second month, the interest is calculated on the new total, which is the total amount of the car minus what she paid toward the principal the month before. This process continues for the full term of the loan, with each month’s interest being calculated on the total outstanding amount.

By the end of the 5-year term, Sarah pays about $2,645 in interest, more than half of what she would have paid if the interest wasn’t compounded. In other words, the compounded interest increased her total cost of borrowing by over 50%.

This example demonstrates how understanding the principles of compound interest and the time value of money can help you truly grasp the cost of debt. Knowing this, you should be motivated to pay off any high-interest loans as quickly as possible to minimize the amount of compounded interest you need to pay.

Learn more:

How to Get a House for Free: 6 Shocking Strategies that Actually Work

How Can I Pay Less In Taxes? Shocking Tax Loopholes Exposed: How to Pay Less and Save More

3. Predict your Millionaire Status Date

Recognizing how money grows (and shrinks if you have debt) over time is crucial for becoming a millionaire. Did you know that understanding compound interest and the time value of money can allow you to predict how much you need to save and invest now to achieve millionaire status by a certain date?

Let’s imagine Larisha, who is 25 years old and has no savings so far, but he has a goal to accumulate $1 million by the time she retires at 65. How much would she need to save and invest each month to reach her goal?

To answer this, we’ll need a few assumptions. Let’s say that Larisha’s investments earn an average of 7% per year, compounded monthly. This rate is in line with the long-term average return of the stock market.

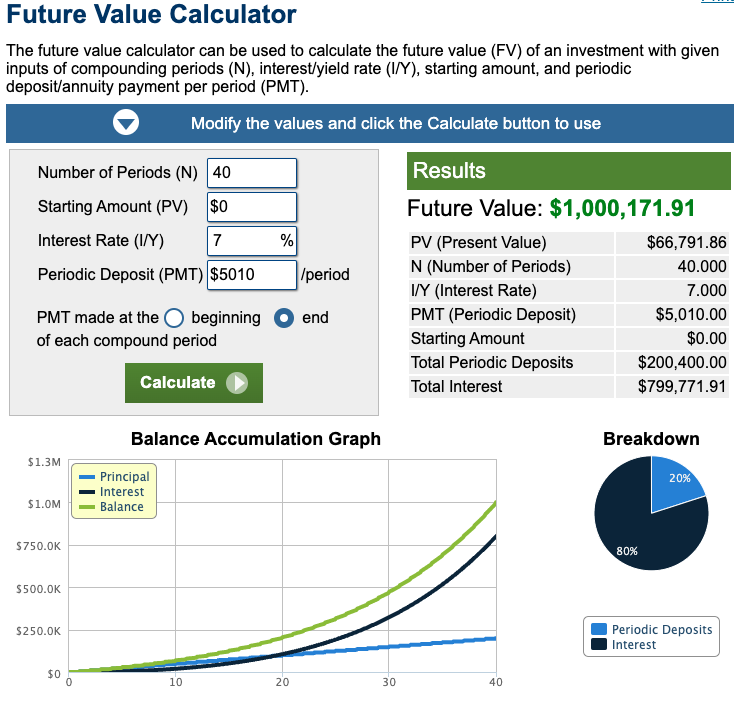

Using the future value formula, which considers both the time value of money and compound interest, we can calculate the monthly savings needed.

If Larisha saves and invests $417.5 monthly from age 25 to 65, she would have just over $1 million by the time she retires, given a 7% average annual return. This calculation considers the money she’s directly contributed and the returns her investments have earned.

However, if Larisha waits until she’s 35 to start saving and investing the same amount each month, she’ll end up with only around $473,248 by the time she’s 65, despite contributing the same amount each month. The difference is due to the reduced time for the compound interest to work its magic, demonstrating the significant impact of the time value of money.

This example shows that by understanding the principles of compound interest and the time value of money, Larisha can predict how much she needs to save and invest regularly to achieve her goal of becoming a millionaire. It also highlights the importance of starting early and investing consistently.

Interested in predicting your millionaire status amount? Check out this free calculator.

How to use this calculator:

- Number of Periods (N): Enter the number of years you plan on investing

- Starting Amount (PV): How much money you are starting with

- Interest Rate (I/Y): Yearly interest rate (7% is a good rule of thumb for the total stock market)

- Periodic Deposit (PMT): How much you plan to invest each year

Larisha’s Example would look like this:

- Number of Periods (N): 40

- Starting Amount (PV): 0

- Interest Rate (I/Y): 7

- Periodic Deposit (PMT): 5010 (take her monthly investment of $417.50 and multiply it by 12 months per year to get $5,010)

Recap

- Becoming a millionaire is a dream for many people, and understanding compound interest and the time value of money is key to achieving this goal.

- Compound interest allows your wealth to grow over time as you earn interest on your original money and the interest it accumulates.

- The time value of money emphasizes that investing early allows your money to grow and take advantage of compound interest.

- The best day to start investing was yesterday; the next best day is today.

- Even small amounts invested regularly can accumulate significantly over time due to compound interest.

- If you have loans with high interest, understand how much they cost you in the long run. Aim to pay off high-interest debts quickly to avoid paying more interest over time.

Remember, the journey to financial success is not a sprint but a marathon. Becoming a self-made millionaire is a calculated endeavor that requires financial management, strategic planning, and persistent action. By unraveling these complex financial principles into actionable steps, you can begin your journey to financial freedom. With patience, consistency, and knowledge, the dream of becoming a self-made millionaire is more attainable than ever.

Frequently Asked Questions

Here are the most frequently asked questions about becoming a self-made millionaire.

What should I invest in?

Stocks

Investing in stocks provides the opportunity for high returns, albeit at a higher risk. A key strategy here is dollar-cost averaging, where regular fixed investments are made over time, regardless of the market’s performance. This reduces the risk associated with short-term market fluctuations.

Warren Buffet, one of the best investors in the world, has been quoted recommending a low-cost index fund like the S&P 500. Check out this video for more:

Bonds

On the other hand, bonds provide a steady income stream and are generally considered safer than stocks. However, you will generally get lower returns. A good investment portfolio has a mix of stocks and bonds. As people get older and require less risk, they generally have more bonds and fewer stocks.

What about taxes?

Efficient tax planning strategies can significantly augment one’s wealth. For example, retirement accounts like 401(k) plans, IRAs, and Roth IRAs offer tax advantages that can lead to substantial savings over time. Furthermore, utilizing long-term capital gains tax rates, tax-loss harvesting, and understanding the estate tax implications can also help in wealth preservation and growth.

I don’t make enough to invest. What should I do?

Developing an entrepreneurial mindset plays a key role in becoming a self-made millionaire. This involves seeking opportunities to create additional income streams. You can do this by seeking more responsibility and raises at your current job, starting a business or side hustle, or investing in real estate, to name a few. By focusing on adding income streams, you can expedite your journey toward the million-dollar mark.

What about bad spending habits?

A self-made millionaire’s journey is also characterized by sound financial habits. These include living below one’s means, avoiding high-interest debt, building an emergency fund, and continuously educating oneself about financial matters. Also, regularly reviewing and adjusting one’s financial plan in response to personal or market changes is imperative to stay on track.

What do I do if the market drops?!

It’s crucial to remember that the path to becoming a self-made millionaire is seldom linear. It may be interspersed with financial setbacks, market downturns, and personal challenges. However, their resilience, discipline, and unwavering focus on their financial goals differentiate self-made millionaires from others.

How do I shorten my timeline for becoming a millionaire?

If you want to shorten your timeline for accumulating a million dollars (or more), you need to increase your savings rate. You can do this by decreasing your expenses, increasing your income, or combining both.

Want More Resources Like This?

Get juicy success hacks and awesome resources related to passive income, personal finance, and positive psychology delivered straight from my brain to yours. Check it out and sign up here.

The Friendly Agreement

If you found value in this resource, please share it. It takes 10 seconds, and this post took me hours to write.

This post may contain affiliate links that allow this blog to earn money without a cost to you. Many thanks if you use them. Please read my disclosure for more info.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. As always, consult with a qualified financial professional before making any investment or financial decisions.